PM Images/DigitalVision via Getty Images

After dropping to a 10-year low of approximately $3.00 per share in March 2020, PENN Entertainment (NASDAQ:PENN) went on an historical run, soaring to over $141.00 per share on March 21, 2021, before reversing direction and plummeting to about $25.50 per share on September 23, 2022, seeming to have found support at that level.

Since then, it has tested $28.00 per share several times, but has managed to hold at close to that share price even under difficult economic conditions and its inability to compete in the U.S. market at the same level as its competitors.

TradingView

The good news is, it appears to have provided a fairly reliable bottom for investors to consider when thinking of taking a position in the company. The bad news is it has yet to prove it can model and scale its Ontario business to the U.S. market, which it is heavily relying on for future growth.

In its last earnings report, it offered guidance for 2023, and it was lower than previous guidance based upon an expected economic downturn in the second half of 2023.

I maintain my thesis that the company could still go either way in 2023, and a lot will have to go right if it’s to surprise to the upside.

In this article we’ll look at its recent earnings numbers, the importance of Ontario concerning the overall growth strategy of the company, and the two major headwinds management sees as having the most potential impact on the company if they continue to weaken.

Recent numbers

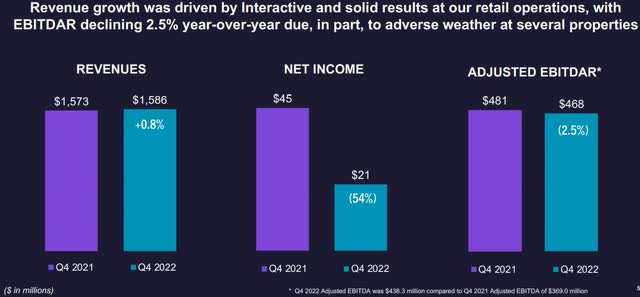

Revenue in the fourth quarter of 2022 was $1.59 billion, compared to revenue of $1.57 billion in the fourth quarter of 2021. Full-year revenue finished at $6.4 billion.

Investor Presentation

Adjusted EBITDAR in the reporting period was $468.00 million, down 2.5 percent from the $481.00 million in adjusted EBITDAR generated in the fourth quarter of 2021. The decline was attributed primarily to bad weather in part of the reporting period. Adjusted EBITDAR for full-year 2022 was $1.94 billion.

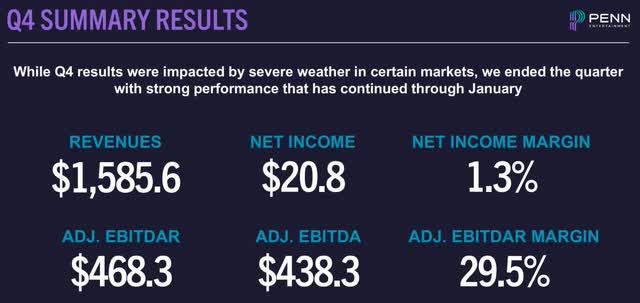

Adjusted EBITDAR margin in the quarter was 29.5 percent, with full year adjusted EBITDAR margin of 30.3 percent.

Net income in the quarter was $21.00 million, or $0.13 per diluted share, down a hefty $24.00 million from net income of $45.00 million, or $0.26 per diluted share in the fourth quarter of 2021. Net income margin in the fourth quarter of 2022 was an anemic 1.3 percent. Net income for full-year 2022 was $221.7 million, with a net income margin of 3.5 percent.

Investor Presentation

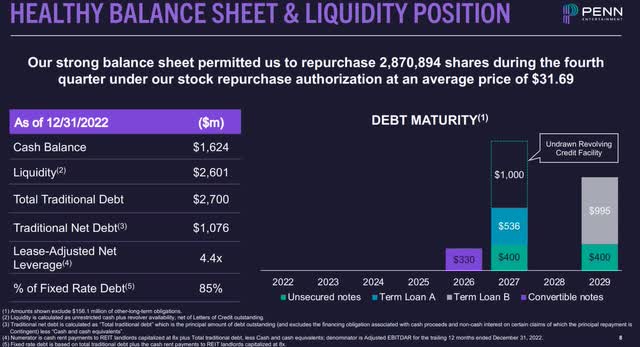

Cash and cash equivalents at the end of the reporting period were $1.62 billion, with total liquidity of $2.6 billion. Total debt was $2.7 billion, with net debt of $1.08 billion.

As for 2023 guidance, the company projects revenue in a range of $6.15 billion to $6.58 billion and an adjusted EBITDAR range of $1.875 billion to $2.0 billion.

Investors Presentation

Its Ontario business

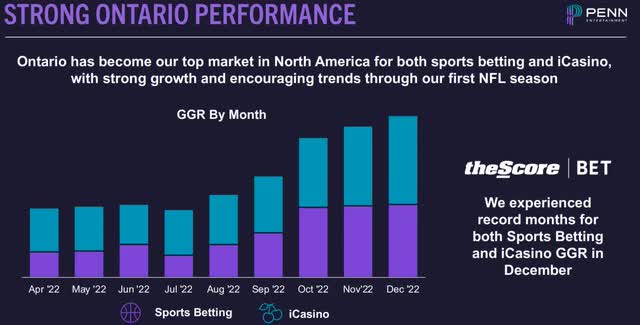

In its recent earnings call, management underscored the importance of continuing to “innovate and iterate” its “best-in-class product in Ontario” because it’s going to be the foundational platform laid there that is exported and scaled to the U.S. market, which is expected to start in the second half of 2023.

Investment Presentation

The company noted that Ontario has been its major focus at this time because of the third-party platforms in the U.S. that it has held back investing in them as it completes its acquisition of Barstool Sports, which when integrated with theScore integrated media and betting platform, should give it similar results as PENN’s now seeing in Ontario.

The company believes that once it invests more in the platform, it’s going to win back sports betting market share it has lost in the U.S. because it hasn’t been able to successfully compete under the third-party platform model. Once it feels it has the capability of competing stronger in the U.S. market, it’s going to starting thinking in terms of acquisitions there again.

If PENN is able to successfully execute on its strategy, and compete at levels it currently is in Ontario, the company has the potential to surprise to the upside in the second half of 2023, and further out.

A positive outcome from Ontario shows that even though the number of competitors operating in the Canadian province has increased by approximately 50 percent in the quarter, it has managed to maintain market share in its most important North American market. Why management sees that as significant is because all the major U.S. and international companies are operating in Ontario, and the assumption is those same competitors will be whom they’ll face in the U.S. market when it’s ready to compete at the same level there, as it does in Ontario.

Investment Presentation

With its migration to the U.S. market, which allows for control of what’s in it product pipeline, along with a platform that can compete with its U.S. counterparts, if the Ontario market reflects how the company will perform in the U.S. going forward, it should be a significant positive catalyst for the company. Nonetheless, the company has yet to prove that its expectations for the strategy will come to fruition.

My conclusion is we probably won’t know how it’s doing until the early part of 2024, when there are a couple of full quarters of performance under its belt.

Two potential headwinds

At the macro-economic level, management, based upon impact from prior years, stated that modest increases in gas prices and interest rates haven’t had much influence on consumer behavior on the performance of the company.

On the other hand, two of the headwinds that have had meaningful impact on PENN’s performance in the past, have been housing and the impact of inflation on employment. Based upon that information, those are the two areas to watch as far as things outside of the control of the company that could have an effect on its numbers.

Concerning housing, management sees it as holding up fairly well after coming down off its peaks, yet with the Federal Reserve expected to continue raising interest rates, rising mortgage payments will definitely continue to slow the housing market down in the quarters ahead.

Even though I still believe the limitations on how high the Fed can raise interest rates remains in place, which I think is at most a little above five percent because of the impact it would have on how high the payment on the U.S. debt would be – which is now approaching $32 trillion – even a couple more increases of 25 basis points would put affordable homes out of reach of a growing number of consumers.

Based upon management commentary, that would probably result in consumers cutting back on spending in the sector.

As for the job market, the numbers recently came out showing a huge surprise to the upside, with 517,000 new jobs being added in the U.S., far surpassing the consensus of 185,000.

This is an interesting outcome as it relates to PENN, because on one hand it implies the job market is robust and consumers will continue to spend. On the opposite side of that is the strong probability the Federal Reserve may decide to raise rates a little higher than I’m thinking, which would put further downward pressure on the housing market.

The best outcome for PENN, in my opinion, is for the Fed to be able to raise interest rates a couple of more times and for the job market to cool off, resulting in interest rates being capped at around 5 percent or a little higher.

If that isn’t how it plays out, the chance for a potentially strong recession in the second half of 2023 would increase in probability. Under that scenario, PENN would take a big hit as consumers tighten up further on spending.

Conclusion

Based upon its recent earnings report and guidance, combined with the conflicting data points that could result in the company going in either direction in 2023, I don’t see any positive catalysts at this time that will help the company break through the $38.00 per share level, which has been the ceiling since April 11, 2022.

If the labor market continues to improve and the Fed shows restraint in raising interest rates, PENN could not only surprise to the upside in 2023, buy may do so in a significant manner. That would be especially true in the second half of the year.

Assuming it’s also able to duplicate the success it has had in the Ontario market, in the U.S. market, the potential some investors believe the company has would start to be seen in its share price.

A lot of things would have to go right for it to play out for PENN in 2023, and at this time, there isn’t any visibility in that regard. Even when looking at probabilities, they aren’t clear either.

Until there is a catalyst that brings about a sustainable growth trajectory for the company, I don’t see it moving outside of its current trading range, which has been from approximately $26.00 per share to $38.00 per share.